NetLease - How do I know if I have a Lease?

With the new lease standards, you may be wondering what is different from the old standards compared to ASC 842, IFRS 16 and GASB 87.

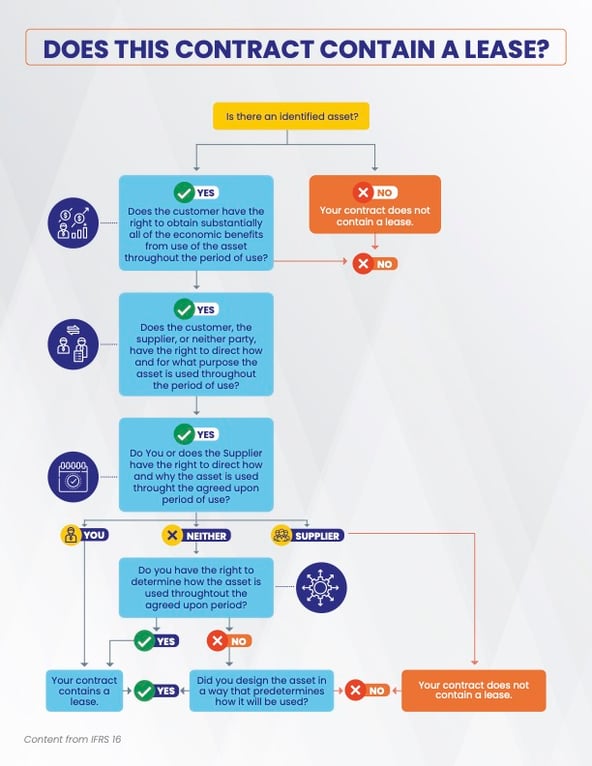

As part of the new leasing standards, all leases must be accounted for on the company’s balance sheet. There are significant changes to how leases are handled. In fact, some of your existing contracts could now be considered leases. If your role is not a specialist in lease accounting, you may need some additional clarification and answering some simple questions will help help you determine if you need to make any changes. Many accountants are looking at this type of decision tree:

This content is helpful, if slightly complicated. Let’s take a look at a simpler version to understand what these above questions are asking:

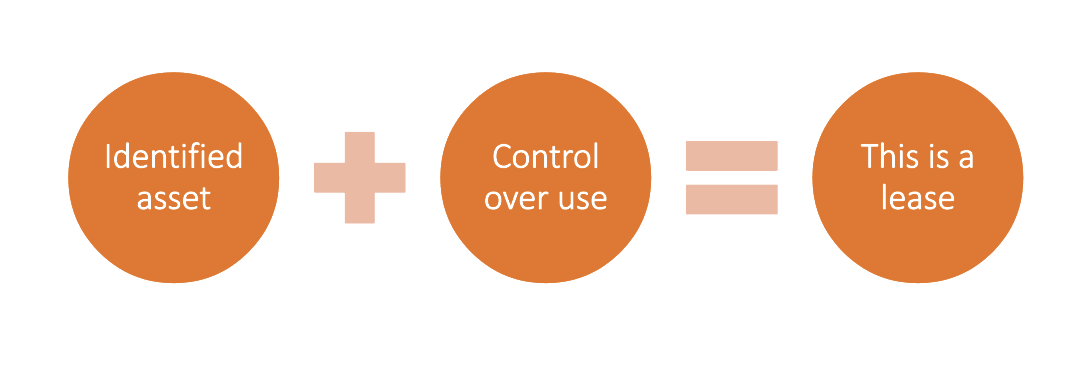

Do you have an asset and do you control the use? If yes to both, then this is a lease. Of course, there are some additional particulars. Let’s look at two examples.

Office space:

If you rent a self-contained space where you have the keys, sole access (not a shared space), and you can use the space however you want for the entire term of the contract, then you have a lease. This example contains a lease because you, the customer:

- Identifies office space is an asset

- Has the right to control the use of the office space

Equipment:

Your manufacturing company enters into a contract with a supplier of forklifts for a period of 6 years. You maintain the forklifts and use them at your discretion. You benefit from the use of the equipment or you could even just park them and not use them. This example contains a lease because you, the customer:

- Identifies the assets as forklifts

- Has the right to control the use of the forklifts

The above examples are two simple instances of leases. In many cases, the information is not always clear. Carefully consider all contract terms, because a service agreement or other contract could contain an embedded lease.

In accounting, the two most common types of leases are financing lease (capital leases) and operating leases but there are also leveraged and non-leveraged leases, conveyance type leases, net and non-net leases, service leases, and more. Regardless of the type of lease, all leases (other than short-term leases) now need to be documented on the balance sheet.

Bottom Line:

With the January 1, 2022 deadline past, companies need to identify their entire collection of leases. Rather than relying on spreadsheets that may have been used in the past for operating leases, the new standards are easier to apply with software like NetLease. For more detailed information, you can reach out to our sales team to schedule a demo of our NetSuite embedded app.